Accidental Death and Dismemberment Insurance: Protecting Your Future

Accidental death and dismemberment insurance (AD&D) is a critical form of coverage that provides financial protection in the event of unexpected accidents resulting in death or severe injuries. While many individuals prioritize life insurance, AD&D insurance offers additional benefits specifically tailored to accidents. In this comprehensive blog article, we will delve into the details of AD&D insurance, ensuring you have a thorough understanding of this vital coverage.

Accidents can happen to anyone, regardless of age, occupation, or lifestyle. AD&D insurance provides a safety net for you and your loved ones, offering financial support during the most difficult times. Whether it is a fatal accident or one that results in dismemberment or paralysis, AD&D insurance ensures that you are prepared for the unexpected.

Understanding Accidental Death and Dismemberment Insurance

Accidental death and dismemberment insurance (AD&D) is a type of insurance policy that pays out a benefit in the event of an accident resulting in death or severe injuries. It is important to note that AD&D insurance is different from life insurance, as it specifically covers accidents rather than natural causes or illnesses. This means that AD&D insurance can provide an additional layer of financial protection for you and your loved ones.

What Qualifies as an Accident?

For an incident to be considered an accident under AD&D insurance, it must be an unforeseen and unintentional event that results in death or serious bodily harm. These accidents can include car accidents, falls, drowning, and other unexpected incidents. However, it's important to review the specific terms and conditions of your policy to understand the exact definition of an accident.

Types of Coverage

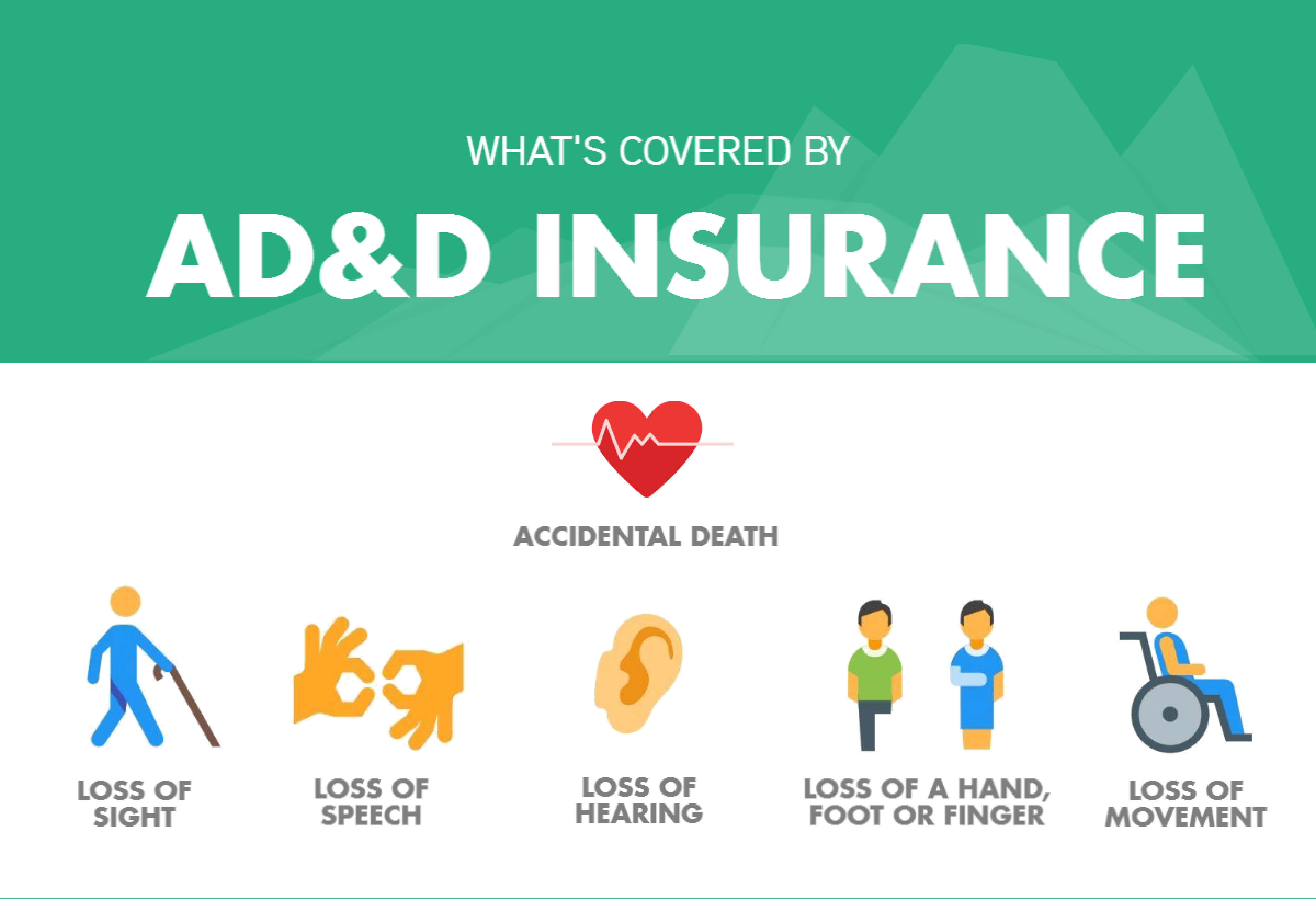

AD&D insurance typically offers two types of coverage: accidental death benefit and dismemberment benefit. The accidental death benefit provides a lump sum payment to the designated beneficiary if the insured person dies due to an accident. The dismemberment benefit, on the other hand, pays a predetermined percentage of the benefit amount if the insured person loses a limb or experiences other specified injuries as a result of an accident.

Key Differences from Other Forms of Coverage

AD&D insurance differs from other forms of coverage, such as life insurance or disability insurance, in several ways. Unlike life insurance, AD&D insurance only covers accidents and not natural causes of death. Additionally, AD&D insurance is typically less expensive than life insurance since it offers coverage for a specific type of event. Disability insurance, on the other hand, provides coverage for injuries or illnesses that prevent the insured person from working, whereas AD&D insurance focuses solely on accidents resulting in death or severe injuries.

The Importance of Accidental Death and Dismemberment Insurance

While it is natural to hope for the best, accidents can and do happen. AD&D insurance is essential for safeguarding your financial future and providing peace of mind for you and your loved ones. Here are a few reasons why AD&D insurance is important:

Financial Implications of Accidents

Accidents can have significant financial implications, especially if they result in long-term medical care, rehabilitation, or loss of income. AD&D insurance provides a financial safety net to help cover these expenses and ensure that your loved ones are not burdened with the financial aftermath of an accident.

Additional Protection Beyond Life Insurance

While life insurance is crucial for providing for your loved ones after your passing, it may not cover accidents specifically. AD&D insurance complements life insurance by offering additional protection in the event of accidents, ensuring that your loved ones are financially secure in any unforeseen circumstances.

Peace of Mind

Having AD&D insurance can provide you with peace of mind, knowing that you have taken steps to protect yourself and your loved ones from the financial consequences of accidents. This peace of mind allows you to focus on other aspects of your life without constantly worrying about the what-ifs.

Coverage Options and Limitations

When considering AD&D insurance, it is important to understand the various coverage options and limitations. Here are some key factors to consider:

Policy Types

AD&D insurance policies can vary in terms of coverage amount, duration, and additional benefits. Some policies offer a fixed benefit amount, while others may provide a benefit that is a multiple of your annual salary. It is essential to carefully review the policy's terms and conditions to ensure it meets your specific needs.

Exclusions and Restrictions

AD&D insurance policies may have certain exclusions and restrictions that limit coverage in specific situations. Common exclusions include self-inflicted injuries, drug-related incidents, and accidents that occur while participating in high-risk activities. Familiarize yourself with these exclusions to fully understand the scope of your coverage.

Rider Options

Some AD&D insurance policies offer riders that can be added to enhance coverage. These riders may include options such as accidental medical expense coverage, which helps cover medical costs resulting from an accident, or common carrier coverage, which provides additional benefits if an accident occurs while traveling on public transportation. Assess the riders available and determine if they align with your needs.

Comparing AD&D Insurance with Life Insurance

Both AD&D insurance and life insurance provide financial protection, but they serve different purposes. Understanding the differences can help you decide which type of coverage best suits your needs:

Coverage Type

AD&D insurance specifically covers accidents resulting in death or severe injuries, while life insurance provides coverage for death from any cause, including accidents, illnesses, or natural causes. If you are primarily concerned about accidents, AD&D insurance may be the more suitable option.

Costs and Premiums

AD&D insurance is often more affordable than life insurance since it offers coverage for a specific type of event. Life insurance, on the other hand, provides broader coverage and may have higher premiums due to the increased risk covered. Consider your budget and the level of coverage you require when comparing costs and premiums.

Benefit Payouts

AD&D insurance typically pays out a lump sum benefit to the designated beneficiary if the insured person dies or experiences specified injuries due to an accident. In contrast, life insurance can provide a lump sum payout or periodic payments, depending on the policy. Consider the payout structure that aligns with your financial goals when deciding between the two.

Factors to Consider When Choosing AD&D Insurance

Choosing the right AD&D insurance policy requires careful consideration of various factors. Here are some key points to keep in mind:

Coverage Amount

Determine the appropriate coverage amount based on your financial obligations, such as outstanding debts, mortgage payments, and future expenses. It is essential to strike a balance between affordability and ensuring adequate coverage for your loved ones.

Policy Duration

Consider the length of time you need coverage. If you have dependents or financial responsibilities that will persist for many years, a longer policy duration may be appropriate. Shorter durations may be suitable if your financial obligations are expected to decrease over time.

Premium Costs

Compare premium costs from different insurance providers to find a policy that fits your budget. Keep in mind that lower premiums may come with higher deductibles or coverage limitations, so carefully review the policy details before making a decision.

Additional Benefits

Some AD&D insurance policies offer additional benefits, such as accidental medical expense coverage or education benefits for children. Assess these additional benefits and determine if they align with your specific needs and priorities.

How to File a Claim for Accidental Death and Dismemberment Insurance

Filing a claim for AD&D insurance involves several steps. Follow these guidelines to ensure a smooth process:

Notify the Insurance Company

Inform your insurance company as soon as possible after the accident. Provide them with the necessary details, such as the date, location, and nature of the accident. Follow their instructions regarding the documentation required to initiate the claims process.

Gather Supporting Documentation

Collect all relevant documents related to the accident and the resulting injuries or death. This may include medical reports, police reports, witness statements, and any other evidence that supports your claim. Ensure that you have copies of these documents for your records.

Complete the Claim Forms

Fill out the claim forms provided by the insurance company accurately and thoroughly. Pay attention to any specific requirements or instructions outlined in the forms. Include all necessary details to support your claim, such as the insured person's personal information, policy number, and accident details.

Submit the Claim Forms and Supporting Documents

Submit the completed claim forms and all supporting documents to the insurance company. Ensure that you keep copies of everything you submit for your records. Consider sending the documents via certified mail or through a reliable courier service to have proof of delivery.

Follow Up with the Insurance Company

After submitting your claim, follow up with the insurance company regularly to check the status of your claim. Be proactive and provide any additional information or documentation they may require promptly. Keep a record of all communication with the insurance company throughout the claims process.

FrequentlyFrequently Asked Questions About AD&D Insurance

AD&D insurance can be complex, and you may have questions about its coverage and benefits. Here are answers to some frequently asked questions:

Who is eligible for AD&D insurance?

AD&D insurance eligibility varies depending on the insurance provider. Generally, it is available to individuals within a specific age range, typically 18 to 70 years old. Some policies may have additional eligibility criteria, such as specific health requirements or occupational restrictions. Review the policy terms to determine if you meet the eligibility requirements.

Can I have both AD&D insurance and life insurance?

Absolutely! AD&D insurance and life insurance serve different purposes and can complement each other. While life insurance provides broader coverage, AD&D insurance specifically covers accidents. Having both types of coverage ensures comprehensive protection for you and your loved ones in various scenarios.

Are premiums for AD&D insurance tax-deductible?

In most cases, AD&D insurance premiums are not tax-deductible. However, it's always wise to consult with a tax professional or financial advisor to determine your specific tax situation and any potential deductions that may apply.

Can I purchase AD&D insurance as a standalone policy?

Yes, AD&D insurance can be purchased as a standalone policy without requiring any other forms of coverage. This allows you to tailor your insurance portfolio to your specific needs and budget. However, it's important to assess your overall financial situation and consider other types of coverage, such as life insurance or disability insurance, to ensure comprehensive protection.

What happens if I change jobs or retire?

If you have AD&D insurance through your employer, coverage may cease once you leave the job or retire. However, you may have the option to convert your group policy into an individual policy or explore other coverage options. It is crucial to review the policy terms and consult with your insurance provider to understand the available options.

Accidental Death and Dismemberment Insurance for Travelers

For frequent travelers, AD&D insurance can provide an extra layer of protection when exploring new destinations. Here's why AD&D insurance is essential for travelers:

Coverage during Travel

Accidents can happen anywhere, including while you are traveling. AD&D insurance ensures that you have coverage in the event of accidents that occur abroad, offering financial protection for medical expenses or repatriation of remains if necessary.

Accidental Death Benefit for Air Travel

Many AD&D insurance policies offer additional benefits specific to accidents that occur during air travel. These benefits may include higher benefit amounts for accidents on commercial flights or coverage for accidents that occur while boarding or disembarking an aircraft.

Emergency Medical Evacuation Coverage

Some AD&D insurance policies include emergency medical evacuation coverage, which can be invaluable if you experience a severe accident or medical emergency while traveling. This coverage can cover the costs of transportation to the nearest appropriate medical facility or even repatriation to your home country if necessary.

Trip Interruption Coverage

In the event of an accident resulting in severe injuries during your trip, AD&D insurance may provide coverage for trip interruption. This can help reimburse non-refundable expenses or additional costs incurred due to the interruption of your travel plans.

The Role of AD&D Insurance in Estate Planning

AD&D insurance can play a vital role in estate planning, ensuring your loved ones are financially secure even after your passing. Here's how AD&D insurance fits into your estate plan:

Immediate Financial Support

If an accident results in your death, the AD&D insurance benefit can provide immediate financial support to your designated beneficiaries. This benefit can help cover funeral expenses, outstanding debts, and daily living costs during the transition period.

Protection for Dependents

If you have dependents who rely on your income, AD&D insurance ensures that they are financially protected even if you are no longer able to provide for them. The benefit can help cover their ongoing living expenses, education costs, and other financial obligations.

Estate Liquidity and Debt Repayment

AD&D insurance can provide liquidity to your estate, ensuring that there are sufficient funds to cover any outstanding debts, taxes, or other financial obligations. This can prevent your loved ones from having to sell assets or face financial hardships to settle these obligations.

Equal Distribution of Assets

By including AD&D insurance in your estate plan, you can help ensure that your assets are distributed equally among your beneficiaries. This can be especially important if you have complex family dynamics or specific wishes for how your assets should be divided.

Seeking Professional Advice for AD&D Insurance

While this article provides a comprehensive overview of AD&D insurance, it is crucial to seek professional advice when making decisions regarding your coverage. Insurance agents and financial advisors can offer valuable insights and guidance tailored to your specific needs:

Insurance Agents

Insurance agents specialize in various types of coverage and can help you navigate the complexities of AD&D insurance. They can assess your needs, provide policy options, and assist in selecting the most suitable coverage based on your circumstances.

Financial Advisors

Financial advisors can provide a broader perspective on how AD&D insurance fits into your overall financial plan. They can help you assess your existing coverage, determine the appropriate amount of coverage, and ensure that your insurance portfolio aligns with your long-term financial goals.

Estate Planners

Estate planners can help you integrate AD&D insurance into your estate plan effectively. They can assist in structuring your insurance policies, ensuring that they align with your wishes for asset distribution, debt repayment, and providing for your loved ones after your passing.

In conclusion, accidental death and dismemberment insurance is a reliable and crucial form of coverage that provides financial protection in the event of accidents resulting in death or severe injuries. By understanding the details, importance, and coverage options of AD&D insurance, you can make informed decisions to safeguard your future and that of your loved ones.

Post a Comment for "Accidental Death and Dismemberment Insurance: Protecting Your Future"