Earthquake Insurance in High-Risk Areas: A Comprehensive Guide

Living in high-risk earthquake areas can be unnerving, as the threat of a devastating quake looms overhead. To mitigate the financial repercussions of such a disaster, earthquake insurance becomes a crucial consideration. In this comprehensive guide, we delve into the nuances of earthquake insurance in high-risk areas, providing you with valuable insights and knowledge to make informed decisions.

Understanding the basics of earthquake insurance is essential. We explore the coverage options, deductibles, and premiums associated with earthquake insurance policies, shedding light on what factors may impact your insurance costs. Additionally, we discuss how earthquake insurance differs from standard homeowners' insurance, ensuring you grasp the specifics of this specialized coverage.

Assessing Earthquake Risk in Your Area

Identifying Seismic Zones

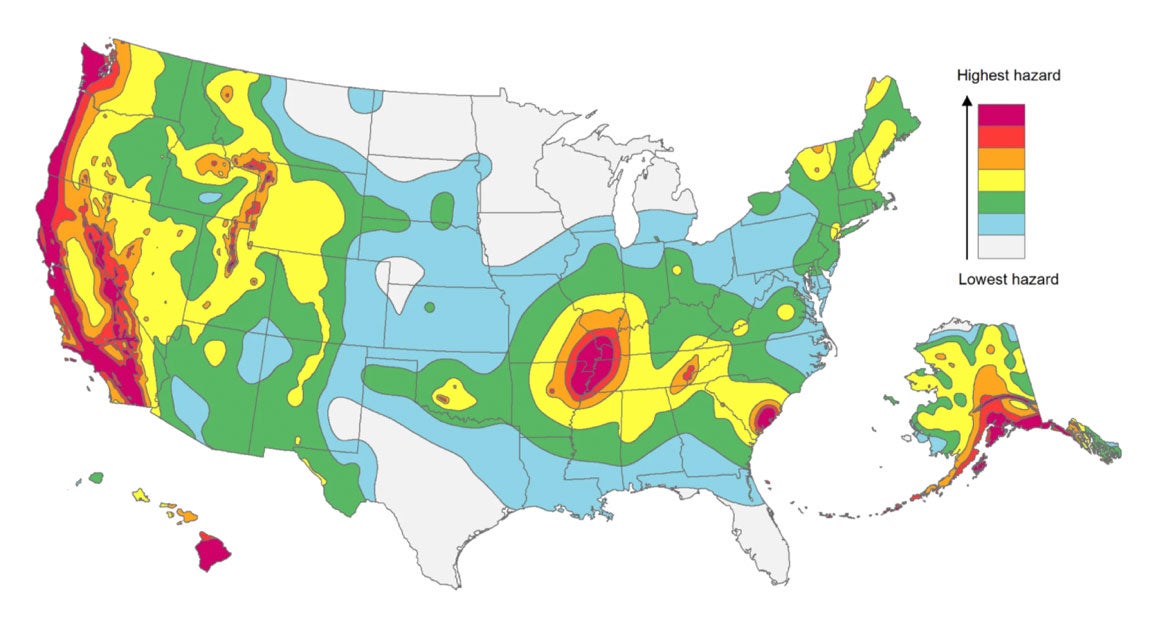

Identifying seismic zones is the first step in assessing earthquake risk. These zones are determined by analyzing historical seismic data and geological studies. By understanding the seismic activity in your region, you can gain insight into the likelihood and intensity of potential earthquakes.

Resources for Assessing Earthquake Risk

Various resources are available to assess earthquake risk in your area. Government agencies, such as the United States Geological Survey (USGS), provide detailed maps and data on seismic activity. Additionally, local geological surveys and universities often conduct studies and offer valuable information about specific regions.

Engaging Professional Assessments

For a more comprehensive assessment, engaging professional geologists or structural engineers can provide a detailed analysis of the seismic hazards specific to your property. These experts can evaluate the soil composition, building codes, and structural vulnerabilities, helping you make informed decisions about earthquake insurance.

Understanding Earthquake Insurance Coverage

Dwelling Coverage

Dwelling coverage in earthquake insurance protects your home's structure and foundation. This coverage typically includes the cost of repairs or rebuilding in the event of earthquake damage. Understanding the limits and exclusions of your dwelling coverage is crucial to ensure you have adequate protection.

Personal Property Coverage

Personal property coverage safeguards your belongings in the event of earthquake-related damage or loss. This coverage extends to items such as furniture, electronics, and appliances. It's important to take inventory of your possessions and assess their value to determine the appropriate coverage amount.

Additional Living Expenses Coverage

In the event that your home becomes uninhabitable due to earthquake damage, additional living expenses coverage can help cover the cost of temporary housing, meals, and other necessary expenses. Understanding the limitations and duration of this coverage is essential to ensure you have adequate support during the recovery period.

Endorsements and Optional Coverages

Depending on your specific needs, you may consider additional endorsements or optional coverages for specialized items or risks. These may include coverage for valuable artwork, home office equipment, or increased coverage limits for specific categories of personal property. Assessing your unique circumstances and consulting with your insurance provider can help determine the need for these additional coverages.

Evaluating Deductibles and Premiums

Understanding Deductibles

Deductibles are the out-of-pocket expenses you must pay before your earthquake insurance coverage kicks in. Higher deductibles often result in lower premiums, while lower deductibles lead to higher premiums. Assessing your financial capabilities and risk tolerance will help you determine the deductible that best suits your needs.

Evaluating Premium Factors

Several factors affect earthquake insurance premiums. These may include the location of your property, the age and type of construction, proximity to fault lines, and the value of your home and personal property. Understanding how these factors influence your premiums allows you to make informed decisions and potentially take steps to mitigate higher costs.

Comparing Insurance Providers

Insurance providers may offer varying rates for earthquake insurance coverage. It is essential to obtain quotes from multiple providers and compare their coverage terms, deductibles, and premiums. Additionally, consider the financial stability and reputation of the insurance company to ensure they can meet their obligations in the event of a disaster.

Discounts and Mitigation Incentives

Some insurance providers offer discounts or incentives for implementing certain mitigation measures to reduce earthquake risk. These measures may include retrofitting your home, securing belongings, or installing early warning systems. Inquiring about available discounts and incentives can help make earthquake insurance more affordable without compromising coverage.

Mitigation Measures to Reduce Risk

Structural Retrofitting

Structural retrofitting involves reinforcing the existing structure of your home to make it more resistant to earthquake damage. This may include bolting the structure to the foundation, strengthening walls, or adding shear walls. Consulting with a structural engineer can help determine the appropriate retrofitting measures for your property.

Securing Belongings and Furniture

During an earthquake, unsecured belongings and furniture can become hazardous projectiles. Taking measures to secure heavy furniture, appliances, and valuable items can minimize damage and reduce the risk of injury. Anchoring bookshelves, securing water heaters, and using earthquake straps for large appliances are effective methods of securing your belongings.

Emergency Preparedness and Planning

Creating an emergency plan is crucial to ensure the safety of your family during an earthquake. This plan should include communication strategies, evacuation routes, and a designated meeting point. Additionally, preparing an emergency kit with essential supplies, such as food, water, and first aid items, can help you sustain yourself until assistance arrives.

Understanding Evacuation Procedures

Familiarize yourself with local evacuation procedures and identify the nearest safe locations in the event of an earthquake. Understanding how to safely navigate your surroundings during an emergency can significantly reduce the risk of injury and ensure a prompt response to potential dangers.

The Claims Process: What to Expect

Contacting Your Insurance Provider

Once earthquake damage occurs, promptly contact your insurance provider to initiate the claims process. Provide detailed information about the damage, including photographs and descriptions, to facilitate the assessment and settlement process.

Documenting Damages and Losses

Thoroughly document all earthquake-related damages and losses. Take photographs or videos of the damage, make a detailed inventory of affected personal property, and retain any relevant receipts or invoices. This documentation will serve as evidence during the claims process.

Working with Insurance Adjusters

Insurance adjusters will assess the extent of the earthquake damage and determine the appropriate compensation. Cooperate fully with the adjusters, providing them with access to the damaged property and any necessary documentation. Maintain open communication throughout the process to ensure a fair assessment.

Maximizing Your Claim Settlement

To maximize your claim settlement, it is essential to understand the coverage limits and exclusions of your policy. Work closely with your insurance adjuster to ensure all eligible damages are accounted for and properly compensated. If you encounter any difficulties or disputes, consult with a public adjuster or seek legal advice to protect your rights.

Exclusions and Limitations in Earthquake Insurance

Pre-Existing Damage Exclusions

Earthquake insurance typically excludes coverage for pre-existing damage. Any damage that occurred before the earthquake insurance policy's effective date will not be eligible for compensation. It is essential to document the condition of your property before obtaining earthquake insurance to avoid potential disputes.

Exclusions for Landslides and Sinkholes

Most earthquake insurance policies exclude coverage for damages caused by landslides or sinkholes. These events often have separate insurance coverage requirements. If landslides or sinkholes are prevalent in your area, consider additional insurance coverage or consult with your insurance provider to assess your options.

Water Damage Limitations

While earthquake insurance covers damage caused by shaking and ground movement, it typically does not cover water damage resulting from flooding or broken pipes. Understanding the limitations of water damage coverage can help you take additional measures to protect your property and consider supplementary coverage if necessary.

Other Exclusions to Be Aware Of

Earthquake insurance policies may have additional exclusions, such as damage caused by nuclear accidents, war, or acts of terrorism. It is crucial to review the policy carefully and seek clarification from your insurance provider to ensure you understand all the exclusions and limitations applicable to your coverage.

Alternative Risk Transfer Options

Catastrophe Bonds

Catastrophe bonds are financial instruments that allow investors to provide capital to insurance companies in exchange for high-yield returns. These bonds provide insurance companies with additional financial resources to cover their obligations in the event of a major earthquake. Investing in catastrophe bonds can diversify your risk and potentially offer attractive returns.

Risk-Sharing Pools

Risk-sharing pools are cooperative arrangements where multiple insurance companies pool their resources to provide earthquake insurance coverage. These pools help distribute the risk among participating insurers, ensuring a collective financial capacity to handle large-scale earthquake claims. Exploring the availability of risk-sharing pools in your region can provide alternative options for earthquake insurance coverage.

Government-Backed Insurance Programs

In some countries, government-backed insurance programs provide earthquake coverage to homeowners. These programs are typically established to ensure theavailability of affordable earthquake insurance in high-risk areas. Government-backed programs often offer coverage options and premiums that are more accessible than private insurance providers. Researching and considering government-backed insurance programs can be a viable alternative for obtaining earthquake insurance coverage.

Assessing Policy Reviews and Updates

Regular Policy Reviews

Regularly reviewing your earthquake insurance policy is crucial to ensure it aligns with your evolving needs and circumstances. It is recommended to conduct policy reviews at least annually or whenever significant changes occur, such as renovations, home additions, or changes in property value.

Reevaluating Coverage Limits

As the value of your property and belongings may change over time, it is essential to reevaluate your coverage limits periodically. Consider factors such as inflation, increasing property values, and acquiring valuable items that may necessitate adjusting your coverage limits to adequately protect your assets.

Policy Updates for Mitigation Measures

If you have implemented mitigation measures to reduce earthquake risk, such as retrofitting or securing belongings, it is important to inform your insurance provider. Some insurance companies may offer policy updates or premium discounts for taking proactive steps to mitigate earthquake damage. Consult with your insurance provider to ensure you receive any applicable benefits.

Consulting with an Insurance Professional

If you are uncertain about the adequacy of your earthquake insurance coverage or need assistance with policy reviews, consider consulting with an insurance professional. These experts can help assess your specific needs, evaluate coverage options, and provide recommendations to ensure you have comprehensive and suitable earthquake insurance coverage.

Insurance Discounts and Incentives

Home Retrofitting Discounts

Many insurance providers offer discounts for homeowners who have retrofitted their properties to withstand earthquake forces. Retrofitting measures, such as bolting the structure to the foundation or reinforcing walls, demonstrate proactive efforts to reduce the risk of earthquake damage, making you eligible for potential premium discounts.

Securing Belongings Incentives

Insurance companies may incentivize homeowners to secure their belongings by offering discounts on premiums. Taking steps such as anchoring heavy furniture, installing cabinet latches, and securing electronics can reduce the risk of damage during an earthquake and potentially qualify you for cost-saving incentives.

Discounts for Home Upgrades

Upgrading your home's safety features, such as installing an automatic gas shut-off valve or a seismic shut-off valve for your water supply, can make you eligible for additional discounts on earthquake insurance premiums. These upgrades demonstrate a commitment to minimizing potential risks and may result in reduced insurance costs.

Multiple Policy Discounts

Insurance companies often offer discounts when you bundle multiple policies, such as homeowners' insurance and earthquake insurance, with the same provider. Consolidating your insurance policies with one provider can lead to significant cost savings while maintaining comprehensive coverage.

Consulting with Your Insurance Provider

To explore potential discounts and incentives further, consult with your insurance provider directly. They can provide detailed information about available discounts, eligibility criteria, and any special programs or initiatives that may help reduce the cost of earthquake insurance in high-risk areas.

Expert Advice and Resources

Government Agencies

Government agencies play a crucial role in providing valuable resources and guidance regarding earthquake insurance. The Federal Emergency Management Agency (FEMA) in the United States, for example, offers extensive information, guidelines, and educational materials related to earthquake preparedness and insurance options.

Insurance Associations and Organizations

Insurance associations and organizations often provide informative resources and tools to help homeowners understand earthquake insurance better. These associations can provide guidance on selecting insurance providers, understanding policy terms, and accessing relevant resources for assessing earthquake risk in your area.

Seismic Research Centers

Seismic research centers, such as universities or specialized institutes, conduct extensive studies on earthquakes and seismic activity. These centers often publish reports, studies, and data related to earthquake risk assessment, mitigation measures, and insurance considerations. Accessing these resources can provide valuable insights into earthquake insurance in high-risk areas.

Insurance Professionals and Agents

Consulting with insurance professionals and agents who specialize in earthquake insurance can provide personalized advice tailored to your specific needs. These experts can help you navigate the complexities of earthquake insurance, explain policy terms, and assist in selecting the most suitable coverage options for your high-risk area.

Online Forums and Communities

Engaging with online forums and communities dedicated to earthquake preparedness and insurance can provide a platform for discussions, sharing experiences, and seeking advice from individuals who have firsthand knowledge of earthquake insurance in high-risk areas. These platforms can offer valuable insights and practical tips based on real-life scenarios.

Earthquake insurance in high-risk areas is a vital component of financial preparedness. By understanding the intricacies of earthquake insurance coverage, assessing the risks in your area, and implementing mitigation measures, you can better protect yourself and your property. Regularly reviewing your policy and exploring alternative risk transfer options can ensure your coverage remains adequate over time. Remember, being well-informed and proactive is key to safeguarding your financial well-being should an earthquake strike.

Post a Comment for "Earthquake Insurance in High-Risk Areas: A Comprehensive Guide"